QuickBooks is one of the most popular accounting software platforms in the world, and FreshBooks is one of the most popular alternatives to QuickBooks. While FreshBooks and QuickBooks are often framed as exact competitors, they are designed with two slightly different audiences in mind.

In this guide, we compared QuickBooks and FreshBooks head to head to help you decide which one is the right choice for your business.

Jump to:

- FreshBooks vs. QuickBooks Online: Comparison table

- FreshBooks vs. QuickBooks Online: Pricing

- FreshBooks vs. QuickBooks Online: Feature comparison

- FreshBooks pros and cons

- QuickBooks Online pros and cons

- Should your organization use FreshBooks or QuickBooks Online?

- Our Methodology

FreshBooks vs. QuickBooks Online: Comparison table

| Starting price | ||

| Invoicing and estimates | ||

| Mobile receipt capture | ||

| Inventory management | ||

| Time tracking | ||

| Report types | ||

FreshBooks vs. QuickBooks Online: Pricing

FreshBooks pricing

FreshBooks offers four different pricing tiers to choose from:

- Lite: $17 per month billed monthly or $204 billed yearly. Allows users to bill five clients per month.

- Plus: $30 per month billed monthly or $360 billed yearly. Allows users to bill 50 clients per month.

- Premium: $55 per month billed monthly or $660 billed yearly. Includes unlimited billable clients.

- Select: Custom quote pricing for enterprises.

FreshBooks frequently runs sales for first time customers, so be sure to check the website for the latest offer. For more information, see our full FreshBooks review and check out our comparisons with other popular software:

QuickBooks Online pricing

QuickBooks Online offers four different pricing tiers to choose from:

- QuickBooks Simple Start: costs $30 per month with access for one user.

- QuickBooks Essentials: costs $60 per month with access for up to three users.

- QuickBooks Plus: costs $90 per month with access for up to five users.

- QuickBooks Advanced: costs $200 per month with access for up to 25 users.

First-time QuickBooks customers can choose to explore QuickBooks without committing to a plan by signing up for a 30-day free trial. You can also skip the free trial in favor of locking in 50% off for your first three months — but you can’t choose both.

For more information, see our full QuickBooks Online review and check out our comparisons with other popular software:

- QuickBooks vs. Xero Accounting

- Zoho Books vs. QuickBooks Online

- Sage Accounting vs. QuickBooks Online

FreshBooks vs. QuickBooks Online: Feature comparison

Invoicing and payments

FreshBooks comes pre-loaded with multiple invoice templates that you can customize to match your invoice branding. You can also create an estimate first, then later convert it to an invoice once the customer approves it. FreshBooks will send automatic reminders so you don’t have to nag customers, and you can set up the software to charge upfront deposits or late fees if you’d like. You can even accept credit card and ACH payments directly in FreshBooks to get paid faster.

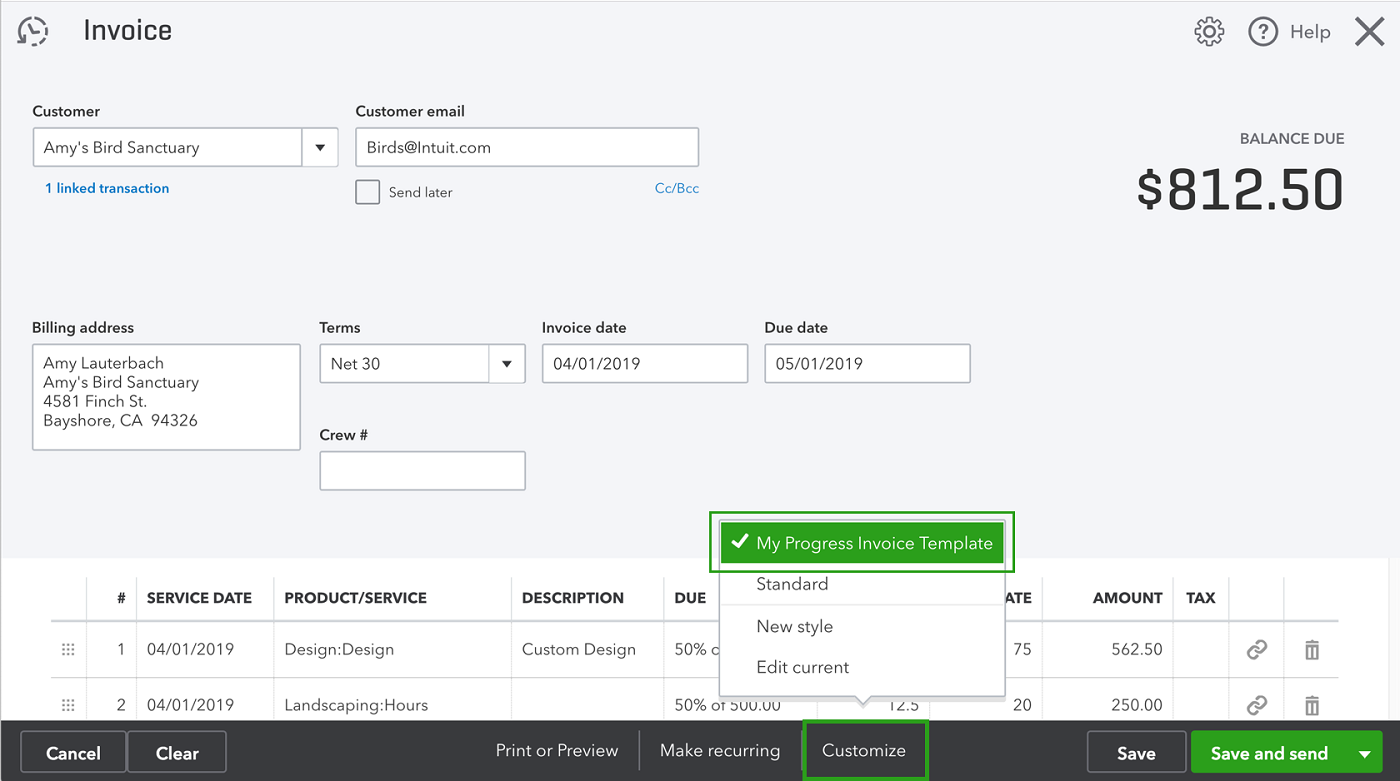

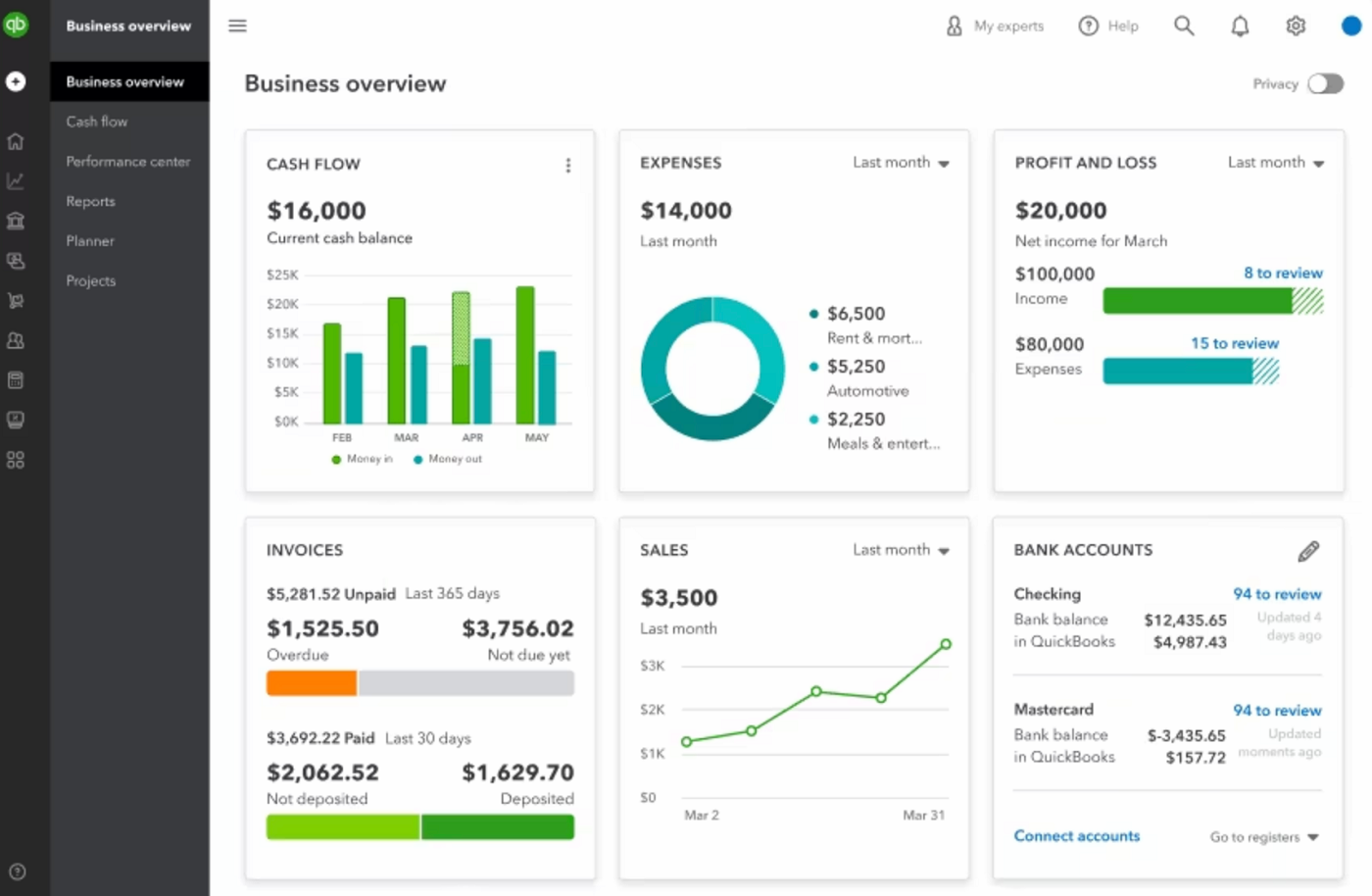

QuickBooks includes many of the same invoicing features, including customizable templates (Figure A) and the ability to track the status of each invoice. Add the option to tip for services to get paid more, or automate recurring invoices to cut down on busy work. QuickBooks also offers the option to send a quick payment request without having to create a full invoice. The software also allows business owners to accept payments via credit or debit, ACH, Apple Pay, PayPal or Venmo.

Figure A

Expense and mileage tracking

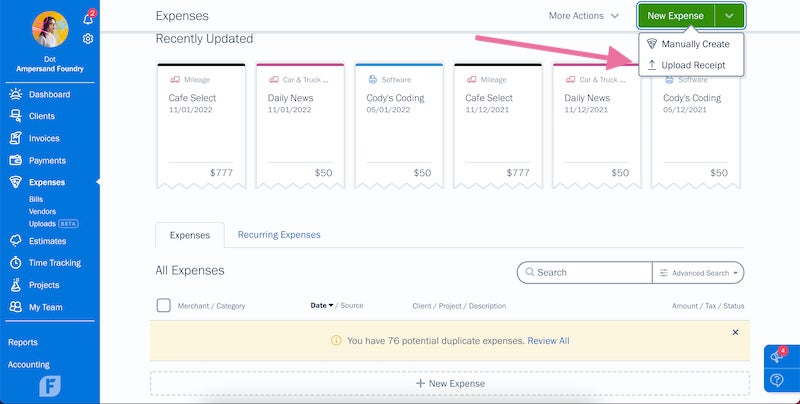

FreshBooks allows users to track unlimited receipts and mileage on all pricing plans (Figure B), but you must upgrade to the Plus plan to get mobile receipt capture. After you connect your bank accounts, FreshBooks will automatically pull in your transaction data and categorize expenses for you. The mobile app will also automatically track all trips, which can be classified as business or personal with a single swipe. If you have the Plus plan, you can snap photos of the receipt and upload them using your phone.

Figure B

QuickBooks offers expense tracking, mileage tracking and mobile receipt capture on all pricing plans, unlike some other software that limits these features to add-ons or more expensive plans. Simply take a photo to upload a receipt within seconds, and QuickBooks will match it to existing expenses or create a new one, in addition to sorting the receipts into various tax categories. The mobile app also helps users accurately track mileage for reimbursement using the phone’s GPS.

Inventory management

After many years of not offering it, FreshBooks finally launched a simple inventory tracking module a few years ago, which is housed under the “Items & Services” page. Simply add an inventory item and the quantity, and FreshBooks will update that number as you sell your items. It will also warn you if you try to add more items to an invoice than you currently have in stock. While these features may suffice for very small businesses, they can’t compare to QuickBooks’ robust inventory management features.

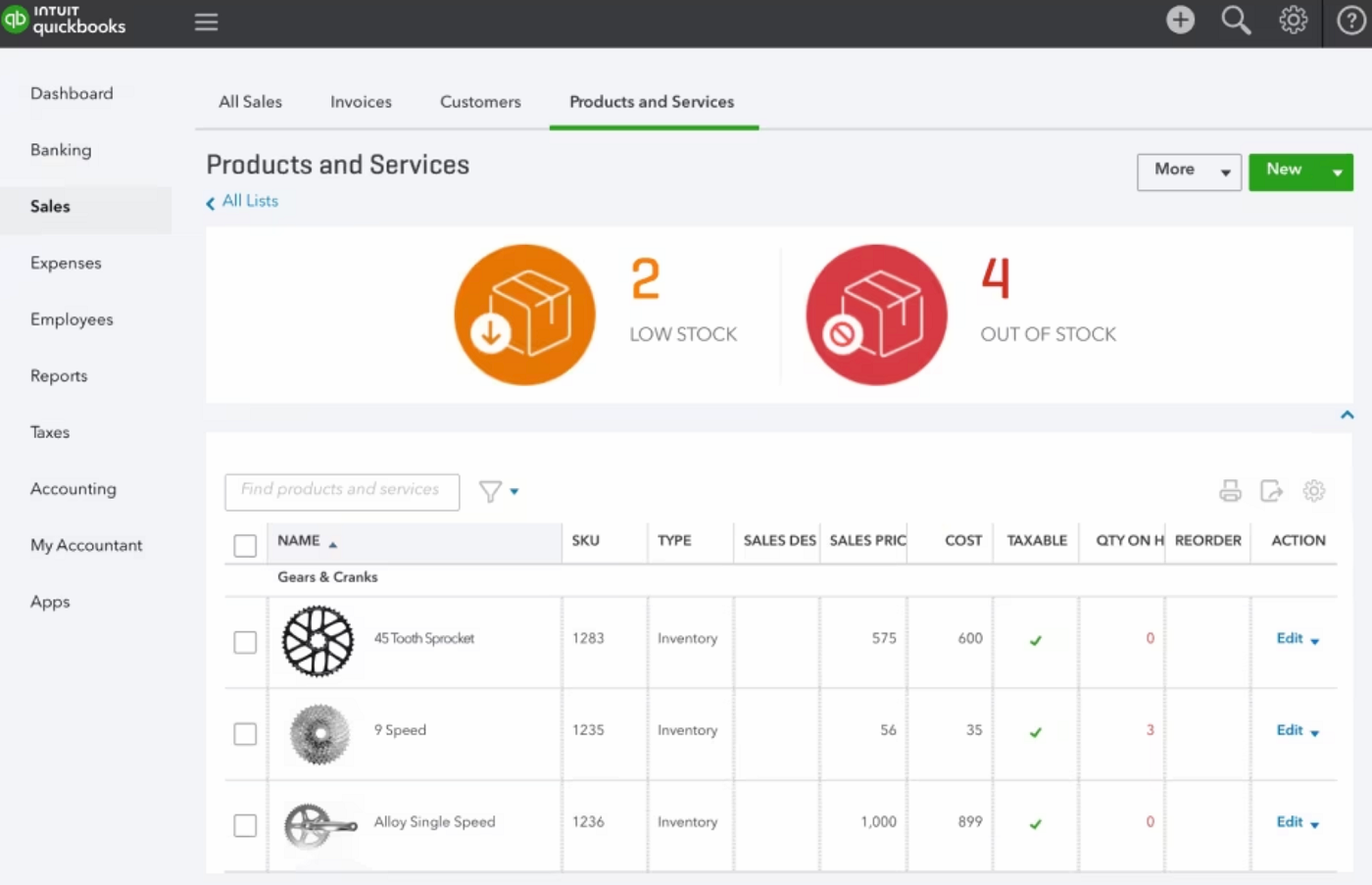

You must upgrade to either the Plus or Advanced plans if you want inventory tracking in QuickBooks (Figure C). Quantities update automatically as you sell items, and the software will issue low stock and out of stock alerts. After your new inventory arrives, QuickBooks takes the purchase order and converts it into a bill. The software also offers several pre-built inventory reports, so you can see what’s selling and what’s not. It also connects with popular ecommerce platforms like Amazon, Etsy and Shopify, so everything syncs seamlessly.

Figure C

Time tracking

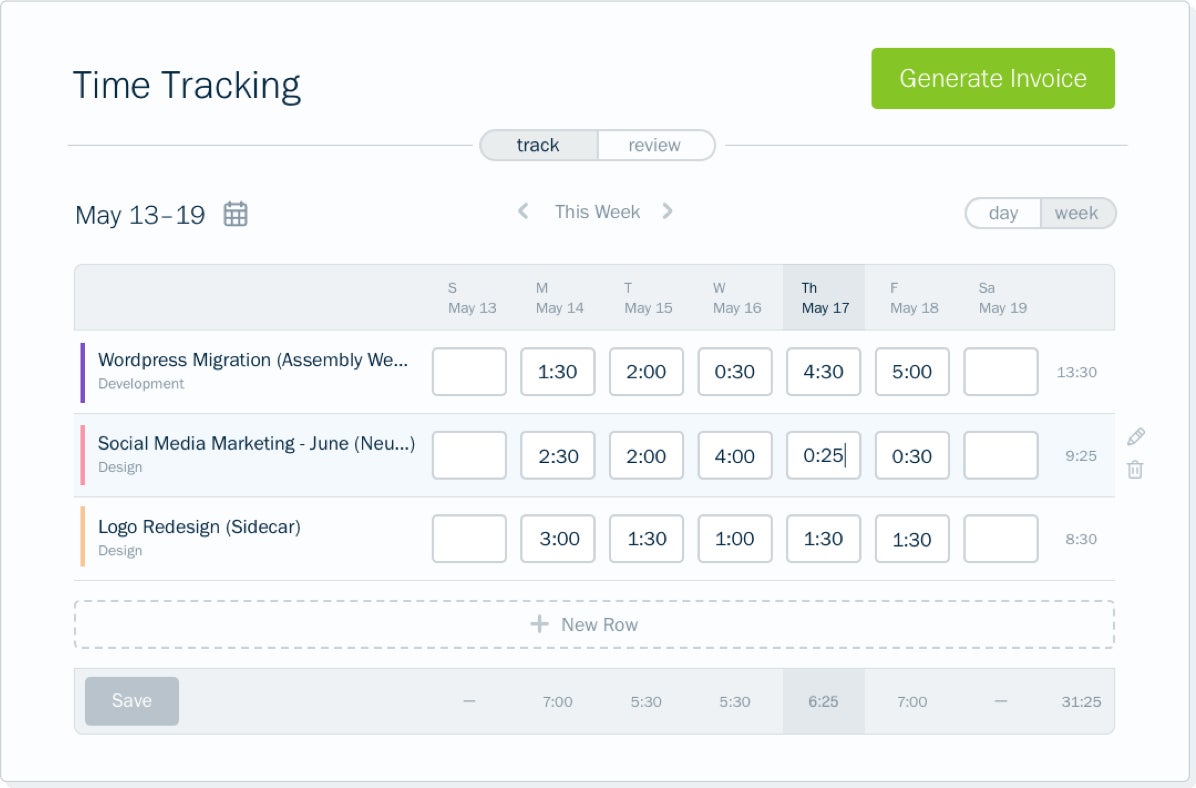

FreshBooks includes time tracking on all pricing plans (Figure D), which is a definite plus if you need this feature. The timer is easy to stop and start as you work, and you can add the finished time logs to bill your hours. You can track time on the web app or the mobile app, or take advantage of the Google Chrome time tracking extension. View your own hours or your entire team’s using the calendar overview feature.

Figure D

QuickBooks also offers time tracking, but you will need to upgrade to at least the Essentials plan to get it. With this feature, you can enter your team’s hours, give them permission to add their own and add time to invoices to make sure you get paid for billable hours. You can also generate profitability reports to see how much an employee or contractor costs your business. For more functionality, you’ll need to add on QuickBooks Time, which starts at $40 per month.

Reporting

FreshBooks offers over 20 finance and accounting reports to choose from, including profit and loss, invoice details and expenses. All account types get access to the tax time and business health reports, but you must upgrade to the Plus plan for double-entry accounting reports. FreshBooks will suffice for many freelancers and small-business owners, but it can’t match the reporting power of other FreshBooks alternatives like QuickBooks.

That’s because QuickBooks offers nearly 60 report types on the Simple Start plan (Figure E), and more expensive plans get access to even more report types. These more detailed reports cover everything from sales by customer to open invoices to payroll deductions. If you want a more detailed analysis of the financial health of your business, then QuickBooks is the way to go.

Figure E

FreshBooks pros and cons

Pros of FreshBooks

- Transparent, affordable pricing plans.

- Well-reviewed mobile apps.

- Time tracking available on all plans.

- Easy invoice and estimate creation tool.

- Intuitive, user-friendly interface.

- Payroll integration with Gusto and SurePayroll.

Cons of FreshBooks

- Lite plan only supports five clients and doesn’t offer mobile receipt capture or accountant access.

- Charges $20 per month for Advanced Payments feature.

- Additional users cost $11 per person per month.

- Fewer third-party integrations than QuickBooks.

- Inventory management is limited.

QuickBooks Online pros and cons

Pros of QuickBooks Online

- Used by many accountants and bookkeepers.

- Free receipt capture offered for all plans.

- Payroll add-on available in all 50 states.

- Sales tax is calculated automatically right in the tool.

- Unlimited invoices, clients and bills on all plans.

- Comprehensive inventory management features.

Cons of QuickBooks Online

- Must choose between a free trial and 50% off the first three months.

- Expensive compared to FreshBooks.

- Capped at 25 users even on the most expensive plan.

- Customer service could be improved.

- Time tracking not available on the least expensive plan.

Should your organization use FreshBooks or QuickBooks Online?

Choose FreshBooks if . . .

- You are new to accounting and want a simple software with a lower learning curve.

- You are a freelancer, solopreneur or small business that doesn’t need very advanced accounting features.

- You are looking for a more budget-friendly software than QuickBooks.

- Your inventory management needs are limited.

- You don’t want to pay extra for time tracking.

Choose QuickBooks Online if . . .

- You are a growing business that needs more advanced accounting tools and you have the budget to pay for them.

- You are confident using accounting software and don’t mind a higher learning curve.

- You want more integrations than FreshBooks offers.

- You need more complex inventory management features.

- You are looking for more detailed analytics and reporting.

Methodology

To compare FreshBooks vs. QuickBooks Online, we took advantage of video demonstrations, product documentation and user reviews. We considered features such as accounting, estimates and invoices, expense tracking, inventory management, time tracking and reporting. We also considered other factors like pricing plans, ease of use, user interface design and more.